-

Transactional advisory services

Find out more about the transactional advisory services of Grant Thornton Financial Advisory Services

-

Valuations

Find out more about the valuations services of Grant Thornton Financial Advisory Services

-

Mergers and acquisitions

Find out more about the merger and acquisition services of Grant Thornton Financial Advisory Services

-

Forensic and investigation services

Find out more about the forensic and investigation services of Grant Thornton Financial Advisory Services

-

Recovery & reorganisation

Find out more about the Recovery & reorganisation services of Grant Thornton Financial Advisory Services

-

Business risk services

Find out more about the business risk services of Grant Thornton Financial Advisory Services

-

Business consulting

Find out more about the business consulting services of Grant Thornton Financial Advisory Services

-

Capital market

Capital market

-

Corporate and business tax

Find out more about our corporate and business tax services.

-

Direct international tax

Find out more about our direct international tax services.

-

Global mobility services

Find out more about our global mobility services.

-

Indirect international tax

Find out more about our indirect international tax services.

-

Transfer pricing

Find out more about our transfer pricing services.

-

Litigation

Our lawyers and accountants can manage all defense measures provided not only by the Italian law, but also by EU regulations and conventions

-

Family business

Find out more about our Family business services.

-

Legal

The client can be assisted in every need and with the same care both on important operations or disputes and on simple matters

-

Back office outsourcing

Find out more about our Back office outsourcing services

-

Business process outsourcing

Find out more about our business process outsourcing services.

-

Compilation of financial statements

Find out more about our compilation of financial statements services.

-

Tax compliance

Find out more about our tax compliance services.

-

Electronic invoicing

Find out more about our electronic invoicing services

-

Electronic storage

Electronic storage is an archiving procedure that guarantees the legal validity of a digitally stored electronic document

-

Revaluation of corporate assets

Find out your civil and fiscal revaluation of tangible, intangible and financial assets

-

Human resources consulting

Find out more about our human resources consulting services.

-

Payroll

Find out more about our payroll services.

-

HR News

HR News the monthly information newsletter by Grant Thornton HR

-

Cybersecurity

GT Digital helps clients structure information security management internal functions, also through partially or totally outsourced functions

-

Agile and Programme Management

GT Digital provides support in the adoption and implementation of different portfolio management

-

Robotic Process Automation

Our “BOT Farm” can rely on digital workers able to help clients in routine activities, allowing employees to deal with more added-value activities

-

Data strategy and management

GT Digital can support clients in seizing the opportunities offered by Big Data, from the definition of strategies to the implementation of systems

-

Enterprise Resource Planning

We support clients in selecting the most appropriate ERP System according to their specific needs, helping them also understand licensing models

-

IT strategy

GT Digital supports clients in making strategic choices, identifying innovation opportunities, comparing themselves with competitors

-

IT service management

We can support with software selection and with the implementation of dedicated tools for the management of ICT processes

-

DORA and NIS 2

The entry into force of the DORA Regulation and NIS2 represents a major step towards the creation of a harmonised regulatory framework

This article provides an overview of the experience accrued by Grant Thornton in the last four years (2018-2021) with reference to the following aspects:

- Overview of the M&A and Due Diligence market;

- Main trends observed on transactions (with a focus on the last 2 years);

- Current context and forecasted trends for 2022.

Overview of the M&A and Due Diligence market

As far as Grant Thornton is concerned, the M&A market and, consequently, the Due Diligence one, recorded an organic growth over the last four years; in particular, a marked growth was recorded in 2021, a trend confirmed also by the data of the first months of 2022.

In our opinion, this growth was mainly driven by:

- an increased opening on the part of Italian entrepreneurs towards capital market and M&A in particular, seen as a growth tool (for example, to enter new markets or to integrate their offer), as well as a way to consolidate their position within their reference industry and as an alternative tool to the traditional debt market;

- the undeniable and now consolidated attractiveness of Italy to foreign investors (mainly in some industries, such as agri-food, medical and scientific, industrial, etc.);

- a low cost of money and of debt, at least until the end of 2021, which allowed buyers to apply a financial leverage at advantageous conditions (benefitting from a less aggressive approach to financial leverage on average, compared to English speaking countries), besides a significant liquidity characterising markets and financial players.

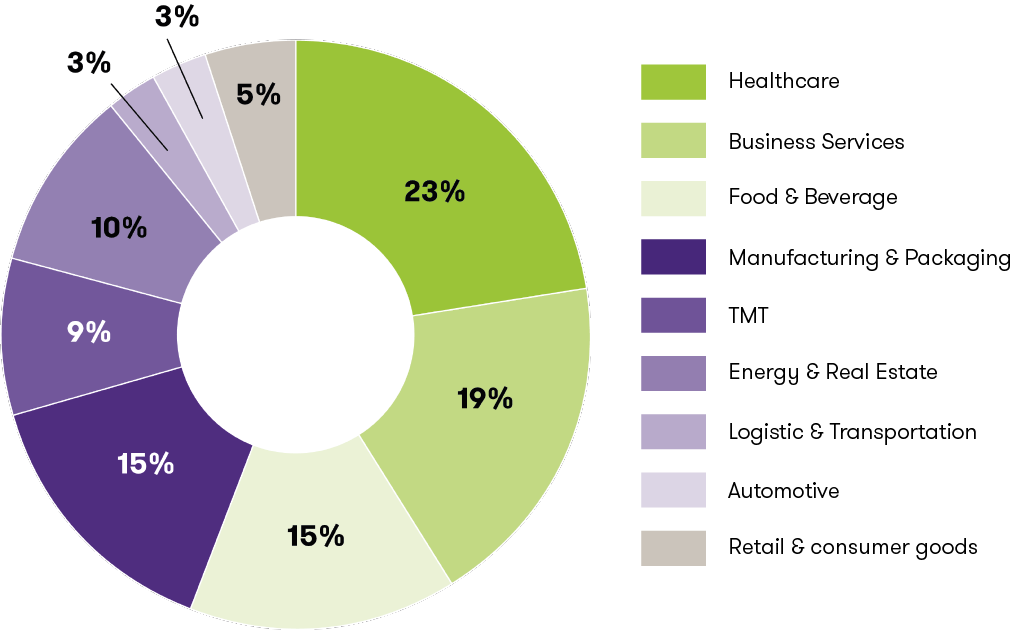

The industries on which our Due Diligence engagements mainly focused in the last four years are shown in the graph below.

Main transaction dynamics observed (focus on the last 24 months)

As for the trends which characterised the transactions in the last four years and, more in detail, in the last 24 months, it is worth specifying that, from our point of view, the global Covid-19 pandemic in 2020 and 2021, though with different effects depending on the industries and locations, did not lead to significant and prolonged setbacks (in terms of volumes and value) of the M&A market. The pandemic probably contributed to accelerating and consolidating some trends which is worth examining in the light of the following factors:

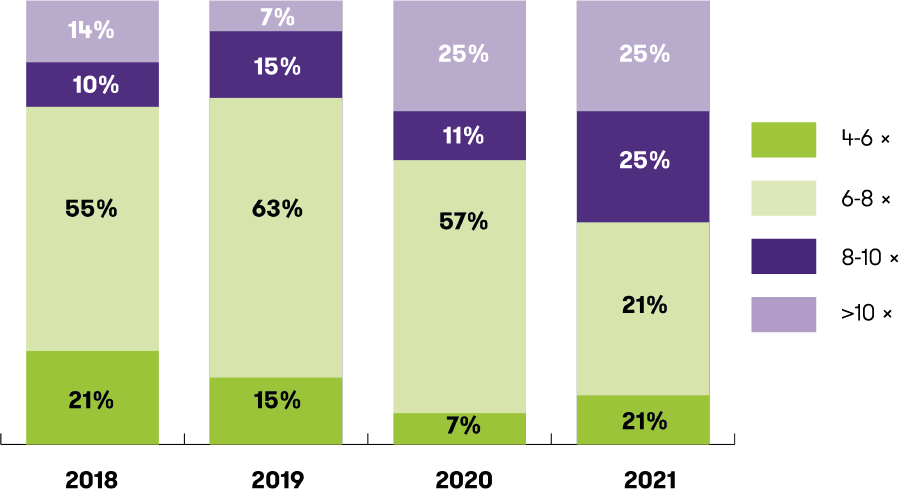

- polarisation of industry multiples, which, especially in 2021, concentrated on the higher end of the range (see graph below), showing a certain market dynamism rewarding business with sound and robust indicators, despite the Covid impact;

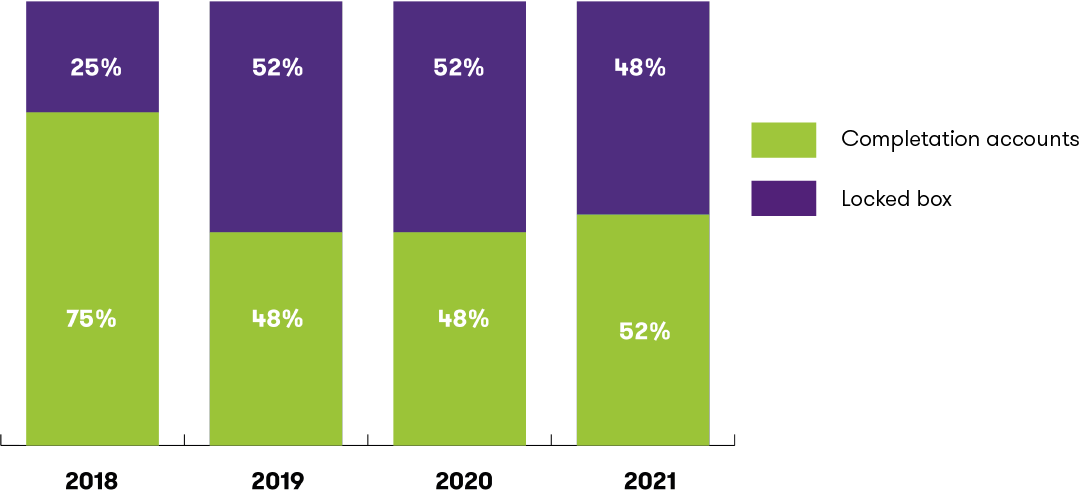

- Closing mechanism (Completion Accounts vs Locked box): before commenting on the trend described above, it is worth mentioning the main difference between the two closing mechanisms, without entering into technical details. According to the Locked Box mechanism, the economic benefits of the operation become effective between the parties from the locked box date, which is usually a date in the recent past taken as a reference to calculate the price of the transaction. On the other hand, the Completion Accounts mechanism provides for that the economic benefits of the operation become effective starting from the closing date and therefore, from the date in which the notary deed of share transfer is executed. The main advantage of the Locked Box mechanism is that the price, net of possible ticking fees, besides the normal clauses provided in the SPA, is known to the parties beforehand and does not undergo subsequent changes (as instead possible with the Completion Account mechanism). In the last four years there has been an increasing application of the Locked Box mechanism for the reasons above, with a slight decrease in 2021, probably attributable to the parties’ will not to fix a price in advance, given the uncertainties in the macro-economic scenario, but rather to consider the actual performances of the companies involved in the potential transaction;

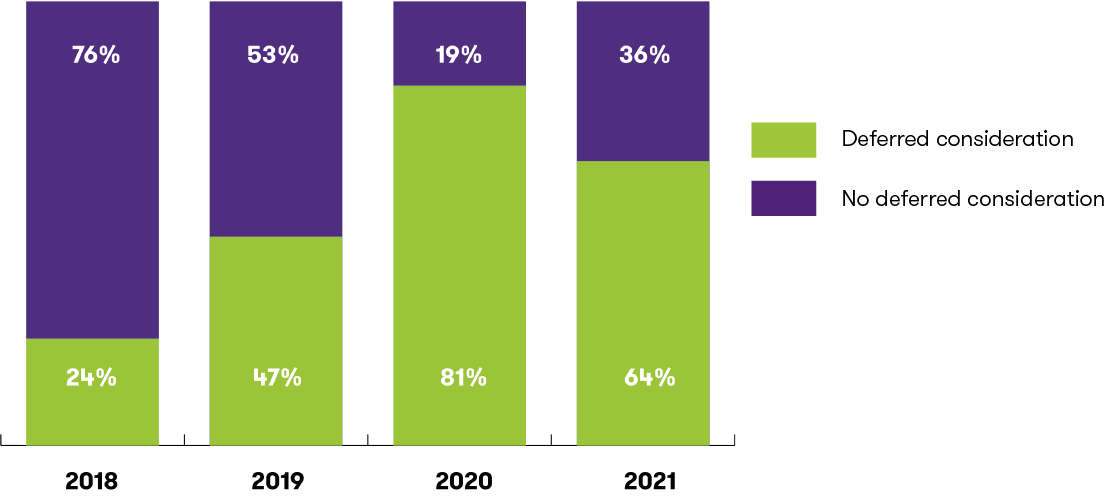

- Deferred Purchase Price mechanisms: the objective uncertainty characterising the last 24 months physiologically led to the application of deferred prices (contrarily to the past, i.e. a higher number of cases in which prices were granted as a lump sum at closing) related to the actual performances of the companies. This mechanism, which application has recorded a marked increase in 2020, as shown in the graph below, has been widely applied also in 2021.

Current scenario and expected trends for 2022

Although the dynamism seen so far in the M&A market seems to characterise also 2022, the macro-economic context is showing a strong uneven outlook compared to the recent past.

Some of the factors which, in our opinion, are having or will have an impact on the transactons (and whose effects are scarcely predictable to date) are:

- the Russia-Ukraine war: in a global market, the strains of the war are impacting the performances of businesses, both in terms of revenues (in case they have a significant portion of turnover generated in the conflicting countries) and in terms of cost base, as better detailed below;

- increased price of raw materials and utilities: the steady increase in prices has caused a delay in leadtimes and led, in many cases, a sharp drop (already experienced or expected) in margins due to the inability to charge the increases on final consumers, at least in the short term;

- impact of the lockdowns in China due to its zero Covid strategy, which impacted not only on consumptions, but also on the sourcing of products from the areas subject to strict restrictions;

- increase in the cost of money and of debt, linked to globally redefined monetary policies to face the inflation target dynamics.

Business must therefore deal with a 2022 budget which could reflect expected margins significantly different from historical ones.

In the light of the above and considering that the last three-year period (a historical period usually taken as reference to identify/normalise the performances of a company) - even more so 2020 and Q1 2022 - has been significantly impacted by the pandemic and by the peculiar macro-economic context, will there be an impact on the trends characterising M&A operations?

In conclusion, we are confident that the Italian M&A market is bound to grow organically in the next few years, but we will probably see short-term adjustments in the next months, aimed at taking into account the uncertainties described above.