How occupational fraud is committed

10 Jul 2018Occupational frauds: how they are committed

Occupational frauds: how they are committed

Depending on the methods used by fraudsters, occupational frauds can be grouped into three macro-categories: asset misappropriation, corruption and financial statements fraud.

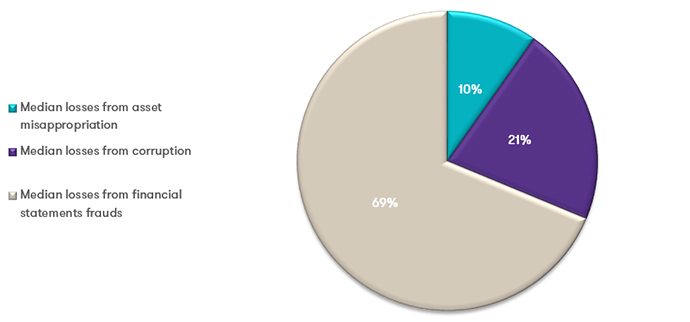

According to the survey ‘2018 Report to the Nations’ conducted by the Association of Certified Fraud Examiners (ACFE), asset misappropriation is the most common fraud scheme (89%), followed by corruption (38%) and financial statements frauds (10%).

We will now examine in detail these fraud schemes. Please consider that methods and schemes may vary according to the industry the victim organization operates in.

Asset misappropriation

This fraud scheme includes, by way of example, the following cases:

- misappropriation of financial resources and assets. Corporate assets are particularly vulnerable because of their high value and the possibility to turn them into cash easily. This category also includes theft of intellectual property, price lists, client databases or other trade information.

- altered expense reimbursements for non-work related expenses, inflated expenses, inexistent expenses or applications for reimbursements filed more than once;

- payroll frauds – distracting payments made in the name of former or fake employees towards the fraudster’s account;

- misappropriation of financial resources by creating shell companies providing fake services.

Corruption

This fraud scheme includes 4 sub-categories:

Conflict of interest

It occurs when an employee, manager or executive holds an un-declared economic or personal interest in a business transaction to the detriment of the enterprise he/she works for. For example: an employee has an economic interest in a supplier and negotiates an agreement for the purchase of goods at an inflated price between the enterprise and the supplier.

Bribery

It occurs when an individual offers, delivers, receives or solicits something valuable for the purpose of influencing an official deed or a corporate decision unbeknownst to or without the consent of his/her employment. For example: (i) an employee validates a supplier’s invoices with inflated prices in exchange for an amount equal to 10% of the higher value; (ii) an employee receives monies from a client in exchange for confidential information about a tender.

Gratuities

It occurs when an individual offers, delivers, receives or solicits something valuable in exchange for an official deed or a corporate decision unbeknownst to or without the consent of his/her employer. For example: an employee negotiates an agreement with a supplier and receives a holiday pack as a thank-you gift.

Extortion

It occurs when a business transaction is carried out through coercion (under personal or economic threats). For example: an employee pressures a supplier to hire one of his/her relatives under threat of discontinuing the purchase of goods or services.

Still according to ACFE 2018 “Report to the Nations”, industries with the highest proportion of corruption cases at a global level are: energy (53%), manufacturing (51%) and government and public administration (50%).

Financial statements frauds

Financial statements frauds are mostly aimed at making the bottom line look better than it is. Overestimating assets, underestimating liabilities or concealing significant information are the methods typically used to show a financial and economic situation which differs from the actual results. The reasons that move perpetrators to commit this fraud scheme can be as different as the methods used. Below are some examples:

- obtaining more funds from banks;

- altering shares prices, in the case of listed companies;

- provide a better economic/financial picture of the corporate accounts to attract investors;

- for managers, to receive performance-related rewarding (bonuses and/or career advancements) to which they would not be otherwise entitled;

- concealing assets or cash misappropriation by altering accounting records.

Usually, fraudsters commit more than one form of fraudulent schemes to maximise the result. Therefore, organizations may become victim of a plurality of illicit conducts where asset misappropriation combines with corruption and often also with financial statement frauds thus making losses more and more sizeable.

According to ACFE 2018 ‘Report to the Nations’, the economic impact of the various form of occupational frauds is inversely proportional to their dissemination. Indeed, while assets misappropriations are by far the most common, they are also the less costly causing a median loss of approx. $114,000. Corruption schemes have a greater impact: the median loss suffered by corruption victim organizations is approx. $250,000. Lastly, the most costly– albeit less common – scheme is financial statement fraud, which caused a median loss of approx. $800.000.

It is not always easy to detect the fraud schemes explained above, because usually they involve also efforts to conceal the misdeeds. According to ACFE 2018 “Report to the Nations”, the top concealing methods used by fraudsters are:

- creation of fraudulent physical documents (55%)

- alteration of physical documents (48%)

- creation of fraudulent transactions in the accounting systems (42%)

- alteration of transactions in the accounting systems (34%)

- alteration of electronic documents and files (31%)

- destruction of physical documents (30%)

- creation of fraudulent electronic files and documents (29%)

- creation of fraudulent journal entries (27%).

For further information or to learn more on our Forensic & Investigation services, please contact Enrico Cimpanelli.