-

Transactional advisory services

Find out more about the transactional advisory services of Grant Thornton Financial Advisory Services

-

Valuations

Find out more about the valuations services of Grant Thornton Financial Advisory Services

-

Mergers and acquisitions

Find out more about the merger and acquisition services of Grant Thornton Financial Advisory Services

-

Forensic and investigation services

Find out more about the forensic and investigation services of Grant Thornton Financial Advisory Services

-

Recovery & reorganisation

Find out more about the Recovery & reorganisation services of Grant Thornton Financial Advisory Services

-

Business risk services

Find out more about the business risk services of Grant Thornton Financial Advisory Services

-

Business consulting

Find out more about the business consulting services of Grant Thornton Financial Advisory Services

-

Capital market

Capital market

-

Corporate and business tax

Find out more about our corporate and business tax services.

-

Direct international tax

Find out more about our direct international tax services.

-

Global mobility services

Find out more about our global mobility services.

-

Indirect international tax

Find out more about our indirect international tax services.

-

Transfer pricing

Find out more about our transfer pricing services.

-

Litigation

Our lawyers and accountants can manage all defense measures provided not only by the Italian law, but also by EU regulations and conventions

-

Family business

Find out more about our Family business services.

-

Legal

The client can be assisted in every need and with the same care both on important operations or disputes and on simple matters

-

Back office outsourcing

Find out more about our Back office outsourcing services

-

Business process outsourcing

Find out more about our business process outsourcing services.

-

Compilation of financial statements

Find out more about our compilation of financial statements services.

-

Tax compliance

Find out more about our tax compliance services.

-

Electronic invoicing

Find out more about our electronic invoicing services

-

Electronic storage

Electronic storage is an archiving procedure that guarantees the legal validity of a digitally stored electronic document

-

Revaluation of corporate assets

Find out your civil and fiscal revaluation of tangible, intangible and financial assets

-

Human resources consulting

Find out more about our human resources consulting services.

-

Payroll

Find out more about our payroll services.

-

HR News

HR News the monthly information newsletter by Grant Thornton HR

-

Cybersecurity

GT Digital helps clients structure information security management internal functions, also through partially or totally outsourced functions

-

Agile and Programme Management

GT Digital provides support in the adoption and implementation of different portfolio management

-

Robotic Process Automation

Our “BOT Farm” can rely on digital workers able to help clients in routine activities, allowing employees to deal with more added-value activities

-

Data strategy and management

GT Digital can support clients in seizing the opportunities offered by Big Data, from the definition of strategies to the implementation of systems

-

Enterprise Resource Planning

We support clients in selecting the most appropriate ERP System according to their specific needs, helping them also understand licensing models

-

IT strategy

GT Digital supports clients in making strategic choices, identifying innovation opportunities, comparing themselves with competitors

-

IT service management

We can support with software selection and with the implementation of dedicated tools for the management of ICT processes

-

DORA and NIS 2

The entry into force of the DORA Regulation and NIS2 represents a major step towards the creation of a harmonised regulatory framework

Provisions on suspension of deadlines relevant to Tax Authorities' activities

Considering the current healthcare emergency and as an exception to the Taxpayers’ Statute, the new norm provides for a postponement of the limitation and prescription periods relevant to the activities of the tax authorities against taxpayers who can benefit from the suspension of tax fulfilments and tax payments. Specifically, the norm provides for that fulfilments and payments due in 2020 are postponed to 31 December 2022.

All suspects of unconstitutionality of the norm aside (the norm, against a few weeks’ suspension of fulfilments and payments in favour of taxpayers, provides for a two-year deferment of the terms in favour of the public administration), some explanations are needed. First of all, the norm should not be applied, not even abstractly, to those taxpayers who have not actually benefitted from the suspensions provided under the Law Decree.

This is the case, for example, of dissolved companies, which, as a result of the provisions of art. 28, para. 4 of Legislative Decree n. 175 of 2014, could actually have received payment orders due within 2020.

Of course, with reference to the above, the tax authorities cannot (at least not on reasonable grounds) request any postponement of the limitation period of the assessment.

This is also the case of a taxpayer with revenues over Euro 2 million, not falling within the scope of activities which benefitted of aids and not located in one of the municipalities of the so-called former “red zone.”

The latter would not benefit from any suspension of taxes and certainly no extension of the 2020 deadlines can be applied to him (as above, not on reasonable grounds).

Similar considerations hold true also for past legal relationships terminated before the enforcement of the “Cura Italia” Law Decree. This is the case, for example, of the limitation period for assessments relevant to the registration tax: the relevant terms could have expired, for instance, in January or February 2020.

Anyway, also in case of such terms, it is clear that no extension can be applied – even if the wording of the norm could leave some doubts – given that otherwise there would be not only a violation of the non-retroactivity prohibition of the tax law (a circumstance occurring more and more often, unfortunately), but, more importantly, a breach not sustained by the principle of reasonableness repeatedly recalled by the Constitutional Court.

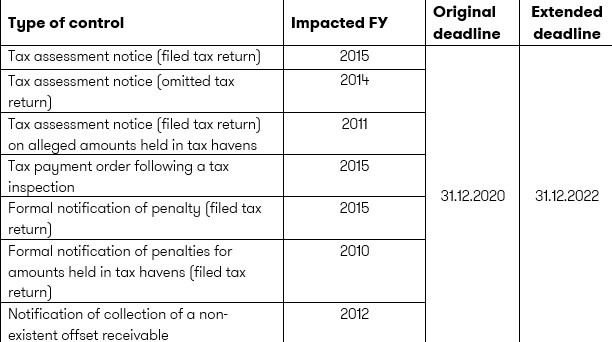

The above being said, the chart below provides some examples of the types of assessment activities which could benefit from the extension of terms:

A further consideration is also needed for those assessment terms, which although expiring on 31.12.2020, have now been postponed to the beginning of 2020 further to specific provisions of law.

This is the case, for example, of VAT assessments terms in case of late response to the request for supporting documents for refunds. Or, again, of the deferment of assessment terms due to anti-abuse questionnaires notified in December 2019. In all the cases above, a case by case analysis is needed.

Our Clever Desk or our Grant Thornton professionals are available to provide you with necessary assistance with reference to your specific situation.