-

Transactional advisory services

Find out more about the transactional advisory services of Grant Thornton Financial Advisory Services

-

Valuations

Find out more about the valuations services of Grant Thornton Financial Advisory Services

-

Mergers and acquisitions

Find out more about the merger and acquisition services of Grant Thornton Financial Advisory Services

-

Forensic and investigation services

Find out more about the forensic and investigation services of Grant Thornton Financial Advisory Services

-

Recovery & reorganisation

Find out more about the Recovery & reorganisation services of Grant Thornton Financial Advisory Services

-

Business risk services

Find out more about the business risk services of Grant Thornton Financial Advisory Services

-

Business consulting

Find out more about the business consulting services of Grant Thornton Financial Advisory Services

-

Capital market

Capital market

-

Corporate and business tax

Find out more about our corporate and business tax services.

-

Direct international tax

Find out more about our direct international tax services.

-

Global mobility services

Find out more about our global mobility services.

-

Indirect international tax

Find out more about our indirect international tax services.

-

Transfer pricing

Find out more about our transfer pricing services.

-

Litigation

Our lawyers and accountants can manage all defense measures provided not only by the Italian law, but also by EU regulations and conventions

-

Family business

Find out more about our Family business services.

-

Legal

The client can be assisted in every need and with the same care both on important operations or disputes and on simple matters

-

Back office outsourcing

Find out more about our Back office outsourcing services

-

Business process outsourcing

Find out more about our business process outsourcing services.

-

Compilation of financial statements

Find out more about our compilation of financial statements services.

-

Tax compliance

Find out more about our tax compliance services.

-

Electronic invoicing

Find out more about our electronic invoicing services

-

Electronic storage

Electronic storage is an archiving procedure that guarantees the legal validity of a digitally stored electronic document

-

Revaluation of corporate assets

Find out your civil and fiscal revaluation of tangible, intangible and financial assets

-

Payroll

Complete and customized payroll service, integrated with digital solutions and compliant with Italian and international regulations.

-

Labor consultancy

We help Italian and international companies manage all aspects of their workforce.

-

HR & Payroll Advisory Services

We review contracts, payroll, and risks for extraordinary transactions and we assess tax, labor, and safety risks in outsourcing contracts.

-

Extended services

We provide integrated digital tools to simplify HR management.

-

HR Infinity Portal

The HR Infinity Portal is Zucchetti’s platform designed to centralize communication between the company and its employees.

-

Cybersecurity

GT Digital helps clients structure information security management internal functions, also through partially or totally outsourced functions

-

Agile and Programme Management

GT Digital provides support in the adoption and implementation of different portfolio management

-

Robotic Process Automation

Our “BOT Farm” can rely on digital workers able to help clients in routine activities, allowing employees to deal with more added-value activities

-

Data strategy and management

GT Digital can support clients in seizing the opportunities offered by Big Data, from the definition of strategies to the implementation of systems

-

Enterprise Resource Planning

We support clients in selecting the most appropriate ERP System according to their specific needs, helping them also understand licensing models

-

IT strategy

GT Digital supports clients in making strategic choices, identifying innovation opportunities, comparing themselves with competitors

-

IT service management

We can support with software selection and with the implementation of dedicated tools for the management of ICT processes

-

DORA and NIS 2

The entry into force of the DORA Regulation and NIS2 represents a major step towards the creation of a harmonised regulatory framework

Financial debt is impacting again on the financial statements of SMEs: this is the trend that we have been seeing over the last 4 years. The slow decrease in the recourse to financial debt registered by Italian companies (and most evidently by SMEs) starting from 2011 has shown a net turnaround starting from 2016 (+0.6%) ad confirmed an increasing trend, registering a growth by 1.7% in 2017 and 2.2% in 2018.

Even if relevant, financial debt for SMEs is now more sustainable: at the same time, they have implemented firm actions for the strengthening of equity capital for years and that have led to an increase in self-financing to a rate higher than 8% per year.

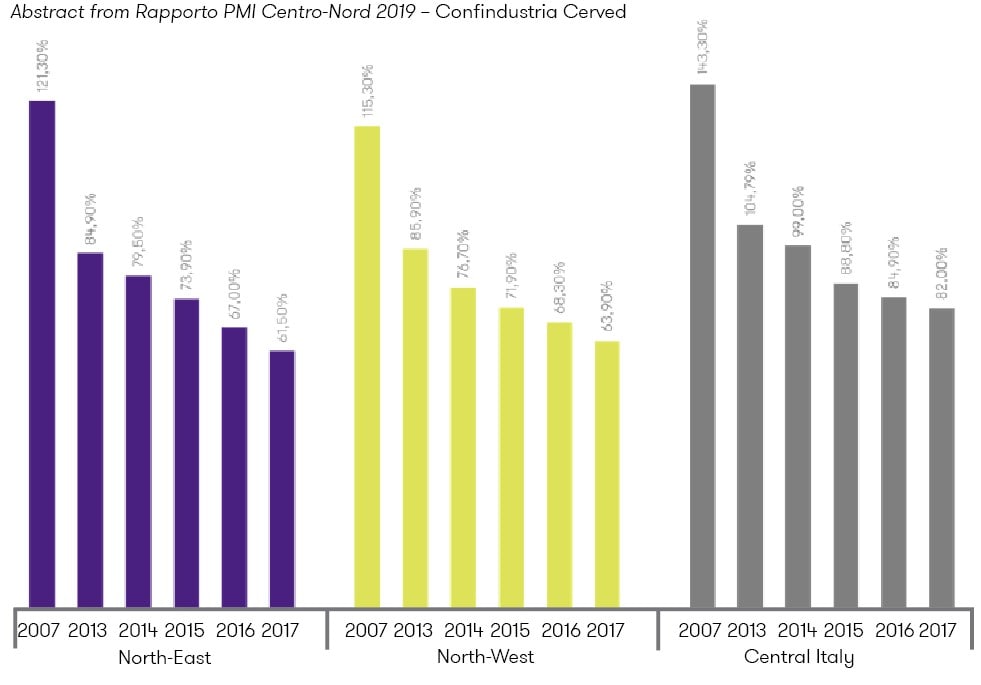

From a geographical perspective, it can be noticed that financial debt of SMEs amounts to slightly more than 60% of net capital in North-East (61.5%) and Nord-West (63.9%), while it is equal to 82% in central Italy. These levels are very different compared to those observed up to less than ten years ago, when the values of financial leverage showed a net prevalence of debt over equity.

A similar trend has been registered by SMEs in Southern Italy, whose recourse to financial debt, though slightly decreasing, shows a higher dependence of southern manufacturing companies on bank credit (financial debt is equal to 85.9% of net capital). This is in line with the different industrial structure of SMEs in Southern Italy compared to other Italian regions.

In fact, the higher concentration of SMEs in the services, construction and agriculture industries in southern Italy compared to other regions and a lower concentration of SMEs in the industrial sector justifies the lower value added compared to SMEs in central and northern Italy.

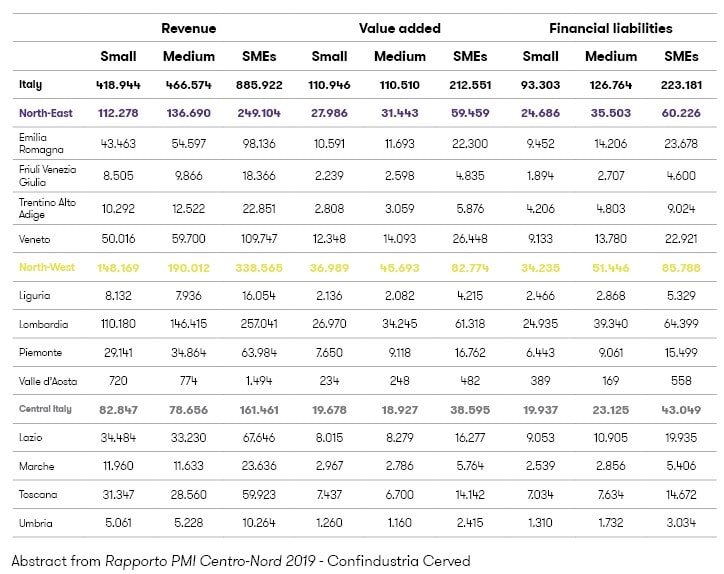

Such data are significant if we consider two further economic indicators, i.e. turnover and value added. In 2016, SMEs in central and northern Italy registered, alone, an overall turnover of 750 billion euros, a value added of slightly more than 180 billion, and financial debt equal to 190 billion.

Particularly, North-Western area reaches the most relevant economic dimensions: SMEs alone in this area produced over twice the turnover of central Italy (equal to approx. 161 billion euros, an added value of 39 billion and debt equal to 43 billion). Though their relevant economic dimension with respect to the total Italian SMEs, SMEs in southern Italy contribute for 18.5% on total SMEs and produce only 15% of turnover and value added, but the percentage of their financial debt is almost the same.

Lombardy is the first Italian Region in terms of SMEs turnover (257 billion), value added (61 billion) and financial debt (64 billion), confirming the trends explained so far.

Also, with reference to the specific category of “Innovative SMEs” in Italy, 2018 figures seem to confirm and even enrich the situation described so far. As highlighted in the latest “Osservatorio PMI innovative – ottobre 2019" [1] (Observatory on innovative SMEs) report, drawn up in collaboration with Bernoni Grant Thornton and the University of Pisa, the phenomenon of self-financing is particularly evident in companies with a turnover equal to or higher than 1 million euros.

Within the sample of analysed companies, in fact, approximately 23.90% shows even an excess in liquidity compared to financial debt. An interesting datum was observed with regard to SMEs with a turnover higher than 15 million euros, which show a higher – or even prevailing – use of financial leverage, with a net gap compared to the lower turnover category.

A further element that has certainly favoured the financial viability of SMEs is the cost of debt, which is at minimum levels thanks to the loose policy of the European Central Bank. SMEs have continued benefitting from low interest rates that have led to increasing investment, financed by a balanced presence of resources generated internally and through the recourse to debt from third parties.

The described dynamics have certainly allowed SMEs to start a path characterized by a new solidity which, however, due to the latest events that have affected Italy and the global economy, risks to be strained by the social and economic dynamics that will presumably have effects starting from 2020 and in the following years.

The current situation of SMEs in the emergency situation

Currently, while the health situation related to the spread of Covid-19 is slowly but constantly improving, the same cannot be said for the economic situation of the country.

This is particularly true for SMEs, which are the foundation of the Italian entrepreneurial system, and which have suffered significant drops in turnover in the last months of the year, with a subsequent prejudice to their financial structure. Outlooks for semester 2, unfortunately, show new difficulties for companies, which will deal with many fulfilments and payments during the recovery of their production activity.

At the moment, the tax and financial moratorium has granted a break to entrepreneurs, but at the end of the summer, new problems deriving from the difficulty in collecting the liquidity necessary to deal with obligations will likely lead to even irreversible crisis situations.

A crucial role is therefore assumed by those instruments introduced by the Government through the many regulatory provisions, aiming to support the financial stability of SMEs. In order to prevent the lacking liquidity from impacting on the leverage of companies, the “Rilancio” Decree (Law Decree dated 19 May 2020, no. 34) – under art. 26 – introduced a concession to incentivize the recapitalization of companies, to strengthen the capital of medium-sized enterprises.

In fact, those companies affected by the emergency situation, whose turnover ranges from 5 to 50 million euros per year, can obtain benefits for both the shareholders – who deal with recapitalization – and for the company itself. Therefore, a tax credit equal to 20% of paid-up capital is provided to subscribers and a further tax credit equal to 50% of losses registered in financial statements 2020 – if exceeding 10% of shareholders’ equity – is provided to the company.

Moreover, the regulation provides for these companies the institution of a fund for SMEs (Fondo Patrimonio PMI) for the subscription of newly-issued bonds.

The legislator also introduced – with particular regard to innovative start-ups – through art. 42 of the “Rilancio” decree (Law Decree dated 19 May 2020, no. 34) a “fund for technology transfer” (Fondo per il trasferimento tecnologico) for companies operating in Italy having assets equal to 500 million euros in 2020. This financing aims to enhance and exploit the outcome of research.

It also aims to incentivize the collaboration between public and private entities for the realization of innovation projects also through the indirect participation of the Ministry for Economic Development in the risk and debt capital of companies.

With regard to loans granted to SMEs to support liquidity and the going concern, the “Liquidità” Decree (Law Decree dated 8 April 2020, no. 23) has provided for the concession of guarantees at concessional terms for loans granted by credit institutes.

In particular, the decree conversion law (Law dated 5 June 2020, no. 40) has strengthened this provision by extending the potential beneficiaries and by increasing the maximum guarantee percentage. With regard to loans of lower amount, the maximum guaranteed amount is 30 thousand euros, the terms for repayment are extended up to 10 years and favourable interest rates are provided.

Lastly, it must be pointed out that there is the possibility for SMEs and start-ups to recapitalise the business through crowdfunding, i.e. an online collection of capital through the use of proper platforms authorized by Consob (Italian National Commission for companies and for the stock exchange) and entered in a proper register. In 2012, Italy was the first country in the world to regularize this procedure, in order to incentivize innovation and technological development.

Now, this practice has been extended to all SMEs (Budget Law 2017) and, moreover, for a few months (Budget Law 2019) interested companies have had the possibility to offer investors not only shares or stock of their capital (so-called equity crowdfunding) but also securities (debt crowdfunding). In fact, the introduction of crowdfunding led to the regularization of a very interesting “innovative” finance instrument through which companies can collect funding from a potentially very high number of subjects – i.e. the “crowd” – and do it online, thus offering companies new channels for capital collection, besides traditional business finance instruments.

The market of crowdfunding, where Italy is a leading country, is registering a very high growth rate and important development scenarios are expected in the future, as confirmed by the results of quarter 1, 2020, where the record amount of 24 million euros was collected for 34 different companies.

[1] The Report was edited by the work team of the Osservatorio PMI Innovative (Obeservatory on Innovative SMEs), established at the University of Pisa in collaboration with Bernoni Grant Thornton. More information here: https://www.openinnovativepmi.it/en/osservatorio/