-

Transactional advisory services

Find out more about the transactional advisory services of Grant Thornton Financial Advisory Services

-

Valuations

Find out more about the valuations services of Grant Thornton Financial Advisory Services

-

Mergers and acquisitions

Find out more about the merger and acquisition services of Grant Thornton Financial Advisory Services

-

Forensic and investigation services

Find out more about the forensic and investigation services of Grant Thornton Financial Advisory Services

-

Recovery & reorganisation

Find out more about the Recovery & reorganisation services of Grant Thornton Financial Advisory Services

-

Business risk services

Find out more about the business risk services of Grant Thornton Financial Advisory Services

-

Business consulting

Find out more about the business consulting services of Grant Thornton Financial Advisory Services

-

Capital market

Capital market

-

Corporate and business tax

Find out more about our corporate and business tax services.

-

Direct international tax

Find out more about our direct international tax services.

-

Global mobility services

Find out more about our global mobility services.

-

Indirect international tax

Find out more about our indirect international tax services.

-

Transfer pricing

Find out more about our transfer pricing services.

-

Litigation

Our lawyers and accountants can manage all defense measures provided not only by the Italian law, but also by EU regulations and conventions

-

Family business

Find out more about our Family business services.

-

Legal

The client can be assisted in every need and with the same care both on important operations or disputes and on simple matters

-

Back office outsourcing

Find out more about our Back office outsourcing services

-

Business process outsourcing

Find out more about our business process outsourcing services.

-

Compilation of financial statements

Find out more about our compilation of financial statements services.

-

Tax compliance

Find out more about our tax compliance services.

-

Electronic invoicing

Find out more about our electronic invoicing services

-

Electronic storage

Electronic storage is an archiving procedure that guarantees the legal validity of a digitally stored electronic document

-

Revaluation of corporate assets

Find out your civil and fiscal revaluation of tangible, intangible and financial assets

-

Payroll

Complete and customized payroll service, integrated with digital solutions and compliant with Italian and international regulations.

-

Labor consultancy

We help Italian and international companies manage all aspects of their workforce.

-

HR & Payroll Advisory Services

We review contracts, payroll, and risks for extraordinary transactions and we assess tax, labor, and safety risks in outsourcing contracts.

-

Extended services

We provide integrated digital tools to simplify HR management.

-

HR Infinity Portal

The HR Infinity Portal is Zucchetti’s platform designed to centralize communication between the company and its employees.

-

Cybersecurity

GT Digital helps clients structure information security management internal functions, also through partially or totally outsourced functions

-

Agile and Programme Management

GT Digital provides support in the adoption and implementation of different portfolio management

-

Robotic Process Automation

Our “BOT Farm” can rely on digital workers able to help clients in routine activities, allowing employees to deal with more added-value activities

-

Data strategy and management

GT Digital can support clients in seizing the opportunities offered by Big Data, from the definition of strategies to the implementation of systems

-

Enterprise Resource Planning

We support clients in selecting the most appropriate ERP System according to their specific needs, helping them also understand licensing models

-

IT strategy

GT Digital supports clients in making strategic choices, identifying innovation opportunities, comparing themselves with competitors

-

IT service management

We can support with software selection and with the implementation of dedicated tools for the management of ICT processes

-

DORA and NIS 2

The entry into force of the DORA Regulation and NIS2 represents a major step towards the creation of a harmonised regulatory framework

The Italian Government has approved a draft decree containing relevant changes to the existing tax regime for inbound workers. The proposed changes (still to be confirmed) impact both the conditions to access the favourable tax regime and the tax advantage itself.

The modifications and novelties only impact the Special Tax Regime (STR) for inbound. The other special tax regimes provided by the Italian legislation (namely the so-called “HNWI regime” or “Flat-tax regime”, regime for university professors and researchers and the special regime for pensioners) are not impacted by the changes currently under discussion and remain in place with no modifications of any kind.

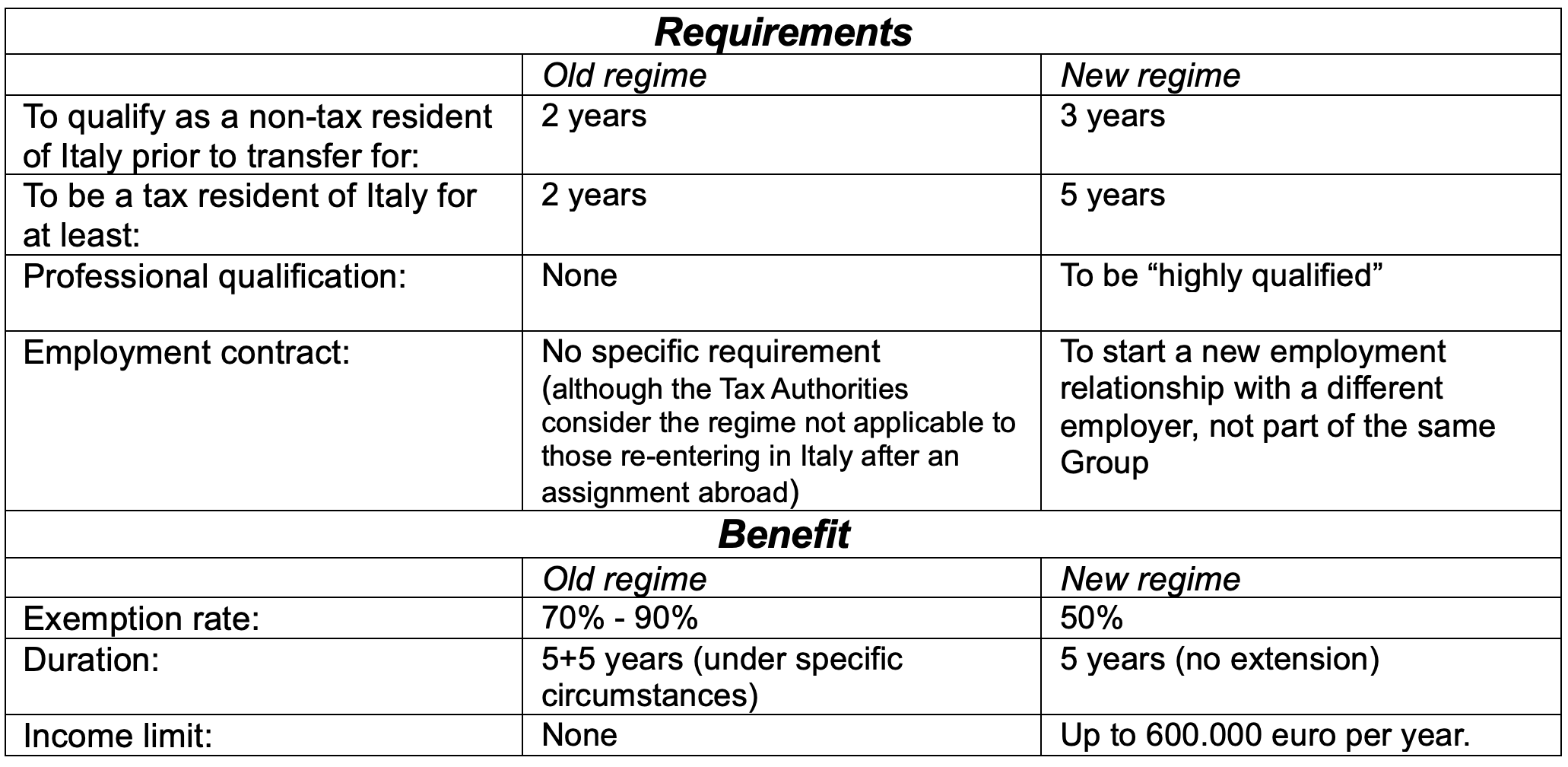

The table below summarizes the main changes currently under discussion.

The modifications should be effective starting from January 1st, 2024 and should only affect inbounds becoming tax resident of Italy after such date. Inbounds who became tax resident of Italy according to the Italian tax rule prior to 2024 should not be impacted (although it is unclear if they will still be able to opt for the extension of the benefit after the initial 5-year period).

As a result of the novelties under discussion, the new tax regime seems to become more focused and addressed to individuals taking up a new employment relationship in Italy and establishing a strong connection with the Italian territory and economy. In this sense, the application of the special tax regime to remote workers (working for the same foreign employer) or assignees seems to become more difficult. Italy do not have any specific regime dedicated to digit nomads, although a law was proposed years ago.

It must be highlighted that all these novelties are currently under discussion and are not a law yet. Modifications cannot be excluded until the publication of the law. By way of instance, in various interviews the vice-minister most involved in the drafting of the new version of the STR has affirmed that the old version of the regime will be applicable to individuals arrived or arriving to Italy in 2023 and registering in the Register of the Resident Population (“Anagrafe”) before December 31, 2023.

Considering that the amendments are not a law yet, should the legislator decide to eliminate the requirements regarding the employment contract, the scope of application of the regime would not be dramatically impacted.

At the same time, the legislator is also reviewing the criteria to qualify as a tax resident of Italy. The new criteria will consider as “Italian days” all those days during which even a portion was spent in Italy. For the purposes of adopting the STR for inbound (or one of the other special tax regimes), the new residency criteria could facilitate the qualification as a tax resident of Italy, hence the application of the STR. All the modifications mentioned in the present document are currently being discussed by the Italian Government and are expected to be effective starting from 2024. It is reasonable to expect the approval of the final law by the end of the year.