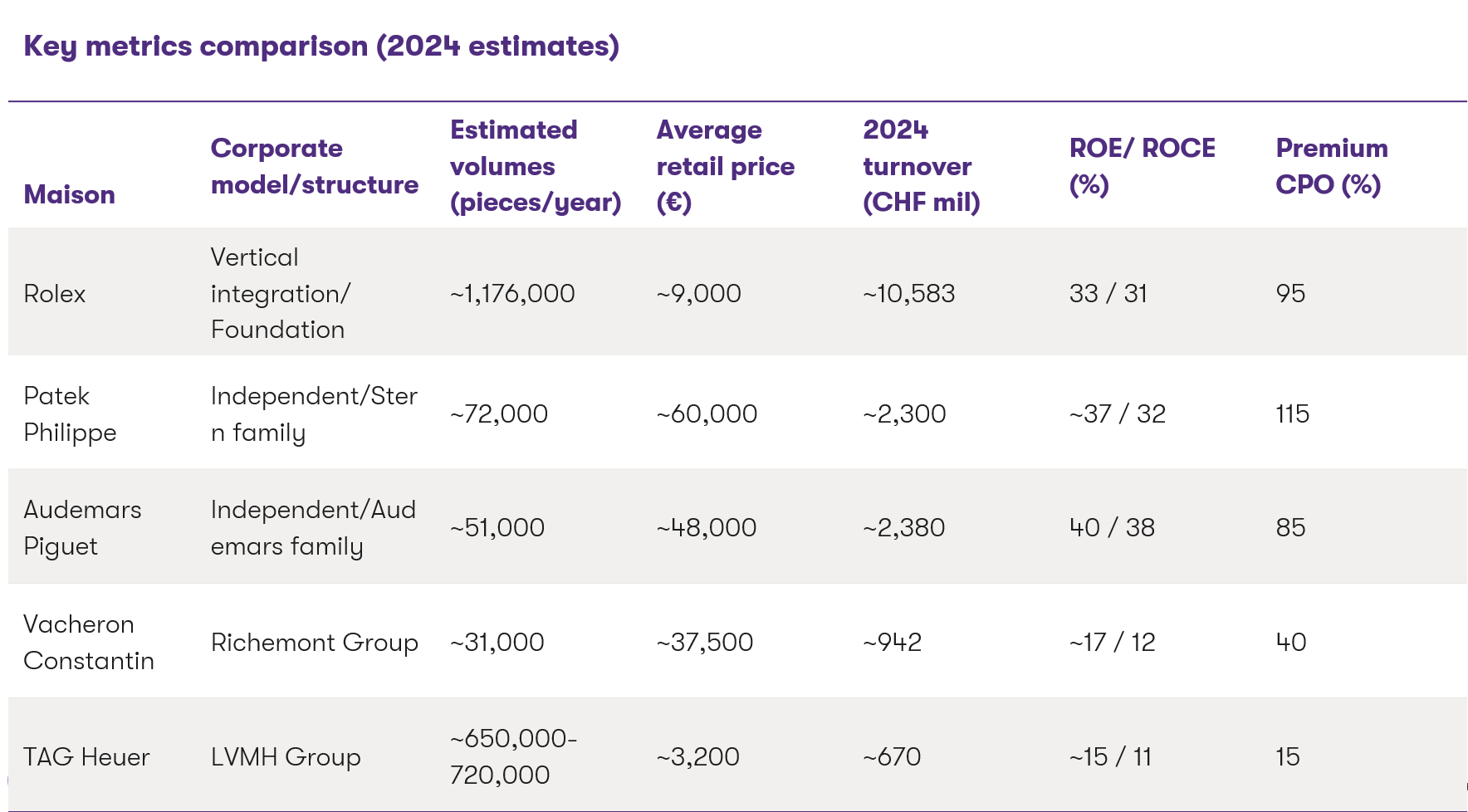

The analysis of the strategies of the main market players (Rolex, Patek Philippe, Audemars Piguet, Vacheron Constantin and TAG Heuer) reveals a direct causal link between governance structure (foundation, family, group) and strategic choices in terms of product, distribution, and lifecycle management.

The table below, based on research data and estimates for 2024, quantifies the performance of the different business models.

Source: Processing of data contained in the thesis " The competitive strategies of high-end watchmakers in the post 2020/2021 bubble period"

Three distinct strategic models emerge from the analysis.

Cluster 1: Groups (Richemont and LVMH)

Brands belonging to large luxury conglomerates play a synergistic role within a larger portfolio. TAG Heuer (LVMH) attacks the market with a modern and hybrid (mechanical/smartwatch) approach, a strong omnichannel model, e-commerce and advanced use of social media and influencers. On the contrary, Vacheron Constantin (Richemont) presides over the niche of traditional fine watchmaking, focusing on the launch of historic collections and managing the secondary market through partnership CPO (certified pre-owned) programs.

Cluster 2: Independents (families)

Family-controlled maisons show two diverging approaches to independence. Patek Philippe (Stern family) is committed to absolute traditionalism: a very rigorous retailer selection, a very limited digital presence and a deliberate choice not to have an official CPO program, maintaining a strategic distance from the secondary market. Audemars Piguet (Audemars family), although independent, adopts the opposite strategy: strong stylistic innovation, contemporary communication (use of celebrities) and, significantly, direct control of the market through the "AP Houses" and a direct CPO program.

Cluster 3: The unique model (the foundation)

Rolex is a strategic unicum. Its governance structure (a foundation) implies an infinite, rather than quarterly timeframe. Every strategic move is aimed at perpetuating the brand: incremental (never revolutionary) product evolution, strong vertical integration, strict control over authorised dealers (ADs) and sober, heritage-centred communication. The launch of an “official CPO programme” is not a tactical move, but yet another expression of a strategy based on consistency and total control, aimed at ensuring the long-term stability of the brand.