Sustainability is nowadays an increasingly relevant driver for organisations that have integrated ESG factors in their trading practices, processes and in their business strategies.

Therefore, sustainability reporting should not be seen as a mere regulatory fulfilment, but rather as an effective tool to attract investors and finance, as well as to build a solid competitive advantage and value for the companies which adopt it.

Moreover, recent studies demonstrate how companies integrating sustainability factors obtain a positive impact on their business opportunities and increased innovation levels, a growth in revenues, easier access to finance at more favourable conditions, besides improving their reputational capital.

On a regulatory level, aware of the urgency to effectively manage ESG related issues, the European legislator has invested increasing efforts in sustainability regulation, issuing among others, Directive (EU) 2022/2464, known as Corporate Sustainability Reporting Directive (CSRD), recently implemented in the Italian regulation with legislative Decree no. 125 dated 6 September 2024, which amended the previous regulation, i.e. that introduces by Directive (EU) 2014/95, Non financial Reporting Directive (NFRD).

The CSRD paved the way for a more attentive regulation of sustainability reporting obligations, effectively broadening the scope of businesses required to report on ESG and introducing more specific reporting criteria, such as the so-called “double materiality”.

On 26 February 2025, the European Commission published its “Omnibus Package” proposal, which should amend the CSRD as for some sustainability reporting obligations, as well as Directive (EU) 2024/1760, also known as Corporate Sustainability Due Diligence Directive (CSDDD).

The proposal aims at limiting sustainability reporting obligations. The main measures introduced include: the amendment of the scope of the subjective obligation, with an increase of dimensional thresholds for the largest companies, the publication of a new voluntary standard (updating the current Voluntary Reporting Standard for Small-Medium Enterprises, VSME), the increase of the value cap chain which limits the maximum number of information that can be required to voluntary reporting entities and to their value chain, the suspension of industry standards, the elimination of the gradual shift from limited assurance to reasonable assurance, the simplification of datapoints currently required by the European Sustainability Reporting Standards (ESRS), a two-year postponement for CSRD and CSDDD required entities, simplifications on environmental taxonomy (for the identification of “sustainable” business activities) and the voluntary reporting of some KPIs.

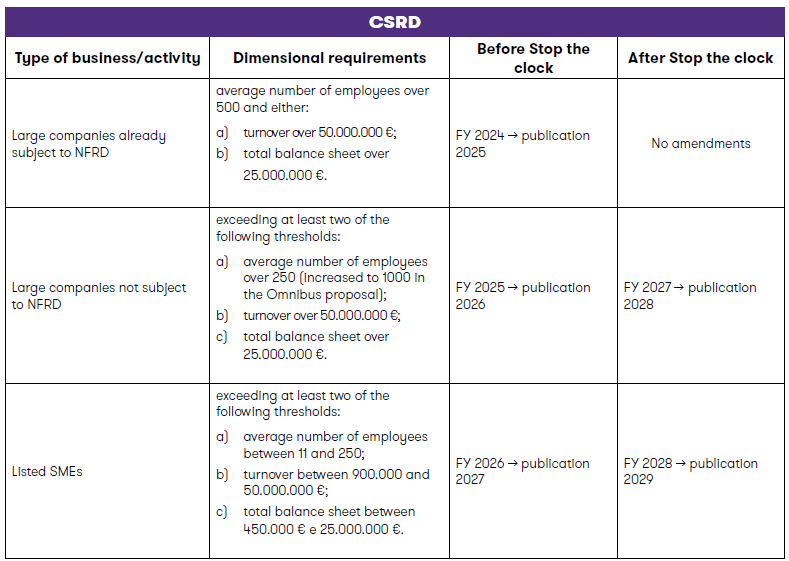

Among the measures above, on 3 April 2025, the European Parliament expressed its favourable vote on the “Stop the clock” directive which postpones the application of sustainability reporting obligations. In particular, this directive falls within the broader strategy of simplification of the reportig obligations provided under the “Omnibus” package. On 14 April 2025, the EU Council also approved the Directive, finally resolving upon the 2-year delay of the application of the CSRD for businesses of the 2nd (i.e. large companies) and 3rd (listed SMEs, small and non-complex entities, captive insurance and reinsurance companies) waves and the one year delay for the implementation and application of the CSDDD. The “Stop the clock” mechanism is not limited to a mere bureaucratic postponement but rather, as declared in the Council official document, a strategic measure to ensure that companies have the necessary time to adapt to the new requirements without compromising their competitiveness. The document also underlines that this measure will enable member States to transpose existing regulations more consistently, in particular to ensure that reporting requirements are proportionate and adapted to the capabilities of businesses, especially SMEs. Directive (EU) 2025/794 was published on the EU Official Gazette on 16 April 2025 and entered into force the following day; member States will have time until 31 December 2025 to implement it in their legislation.

Below is a table showing the impact of the “Stop the clock” Directive on the regulation introduced by the CSRD regarding ESG reporting.

The simplification of sustainability reporting requirements, and its postponement, have raised some criticisms such as that of an excessive weakening of the ESG reporting regulations, which is an indication of less transparency, uniformity and comparability of sustainability information due to the potential phenomenon of unregulated voluntary reporting by companies no longer/not yet obliged.

Despite the understandable criticisms, it is still possible to appreciate the rationale of the simplification intervention implemented by the Legislator. In fact, the intervention redraws the rules in a broader timeframe and consistent with the real operational capabilities of companies. For this reason, companies should seize the opportunity to better prepare, consolidate internal processes and structures and anticipate their change in view of the implementation of sustainability reporting obligations.

In conclusion, therefore, the importance of integrating ESG factors in business management structures is reiterated, since only monitoring sustainability reporting related risks and opportunities and regulatory compliance will allow companies to preserve their value and, indeed, increase it over time.

The postponement of the entry into force of sustainability obligations should, therefore, be welcomed by companies as an opportunity to strengthen their assets, integrating ESG factors into their Internal Governance, thus pursuing corporate sustainability