IBR

-

Contrary to the global trend down by 2 percentage points (from 73% to 71%), the optimism of mid-market business about the economic outlook is on the rise by 4pp in Italy (from 58% to 62%) and by 1pp in Europe (from 61% to 62%)

-

Global businesses are increasingly worrying (60%) about economic uncertainty, seen as the main constraint to growth

-

For business leaders globally, geopolitical conflicts (53%), shortage of orders (50%) and supply chain disruption (49%) are the most critical issues

-

Technology is the main growth driver for the mid-market. IT remains the top investment area, with 68% of business leaders planning to increase spending over the next 12 months

Milan, 30 June 2025 - According to Grant Thornton’s latest International Business Report (IBR), in Q2 2025 the optimism of mid-market businesses continues to decline as a result of the latest trade policy strategies implemented by the President of the United States, Donal Trump. The survey, conducted on a sample of over 2,500 business leaders of mid-market businesses all over the world, shows a global decrease in optimism by 2 percentage points compared to the previous quarter, from 73% to 71%. In Italy, instead, optimism recorded a 4 percentage point increase (from 58% to 62%); the same trend, though to a lesser extent, is also evident in Europe, up one percentage point, from 61% to 62%.

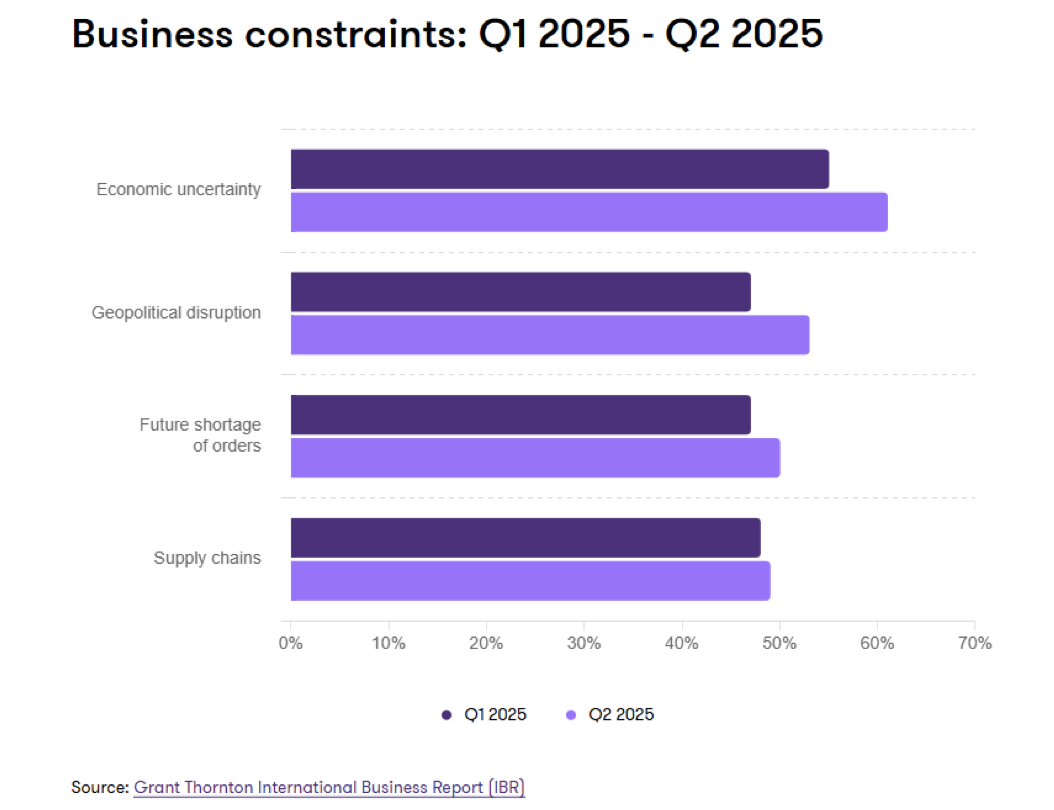

Main constraints reported by mid-market businesses

Despite the negotiations on US tariffs and the 90-day pause on most of them extended until 9 July, business leaders concerns remain high due to the latest initiatives of the Trump administration on trade which, by opening up uncertain scenarios, undermine business confidence.

Economic uncertainty is the constraint to growth most cited by the business leaders involved in the survey, with a 5 percentage points increase to 61% globally, a +3pp increase in Europe (from 47% to 50%) and just one percentage point in Italy (to 51%).

On a global level, there are three main sources of concerns indicated by business leaders as possible constraints to the growth of their business: the increasing geopolitical disruption (+5pp, from 48% to 53%), concerns about supply chains, which reached a record high of 49% (up one point) and concerns about a possible shortage of orders (+4pp, from 46% to 50%).

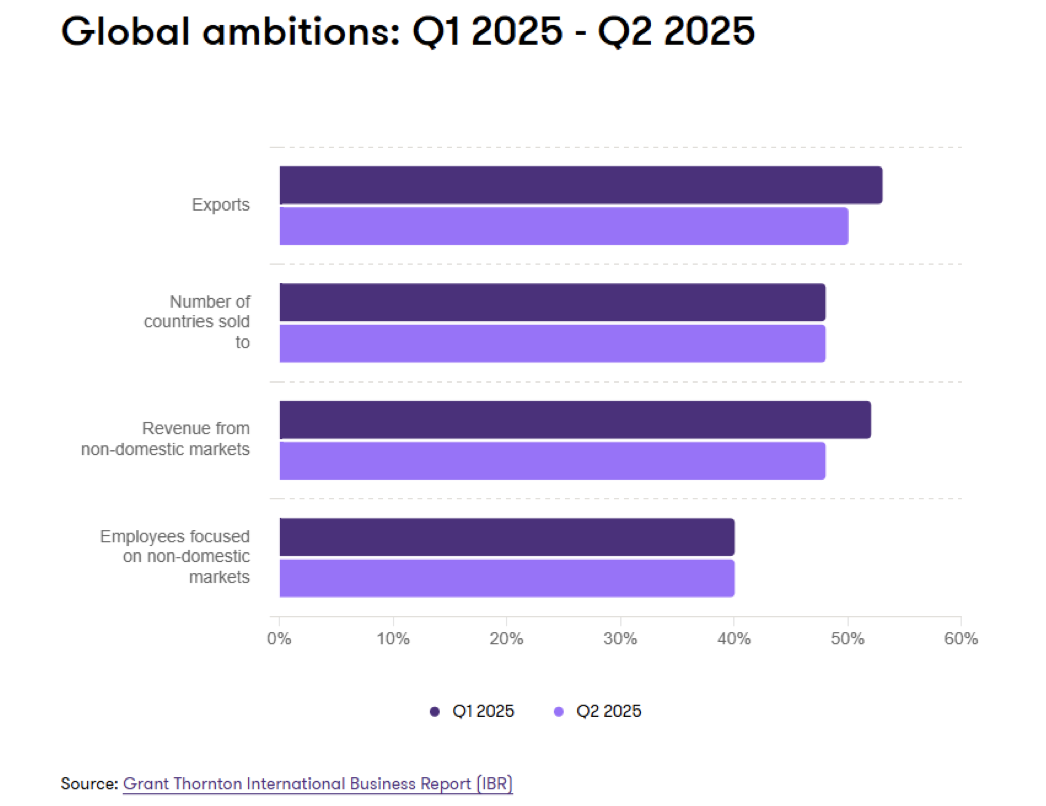

Growth and internationalisation prospects

Despite the rising international uncertainty, mid-market business leaders are not currently expecting it to impact on their trading performance, with 66% expecting to increase revenues over the next 12 months (unchanged from Q1). A similar trend was recorded in Europe (from 61% to 62%) and Italy (from 54% to 55%), both with a 1 percentage point increase. A slightly lower percentage, but nonetheless high, equal to 63% of business leaders (unchanged from Q1) expect increased profitability (in Europe up from 55% to 57% and in Italy from 48% to 51%), and 54% - also unchanged from the previous quarter - expect to raise selling prices (in Europe it also remains unchanged at 53%, whereas in Italy is down from 49% to 45%). This highlights the strong adaptability and ongoing resilience of the mid-market in the global economy.

This rising sense of unease is impacting the mid-market’s international outlook, with the proportion of business leaders expecting to increase exports in the next 12 months down three points (from 53% to 50%). In Europe, on the contrary, there was a3pp uptick (from 46% to 49%), with Italy also recording a slight decrease (-1pp, from 42% to 41%).

The percentage of business leaders expecting an increase in revenues from non-domestic markets fell four points (from 52% to 48%). A downward trend was also recorded in Europe (-1pp, from 47% to 46%) and Italy (-3pp, from 46% to 43%).

However, the percentage of businesses planning to expand the number of countries they sell to remained unchanged at 48% - with a slight increase in Europe (+1pp, from 44% to 45%) and a market increase in Italy (+9pp, from 39% to 48%), as did the share of businesses expecting to increase the number of employees focused on non-domestic markets, which held steady at 40% (same as in Europe, at 38%, while in Italy it increased by 6pp, from 33% to 39%).

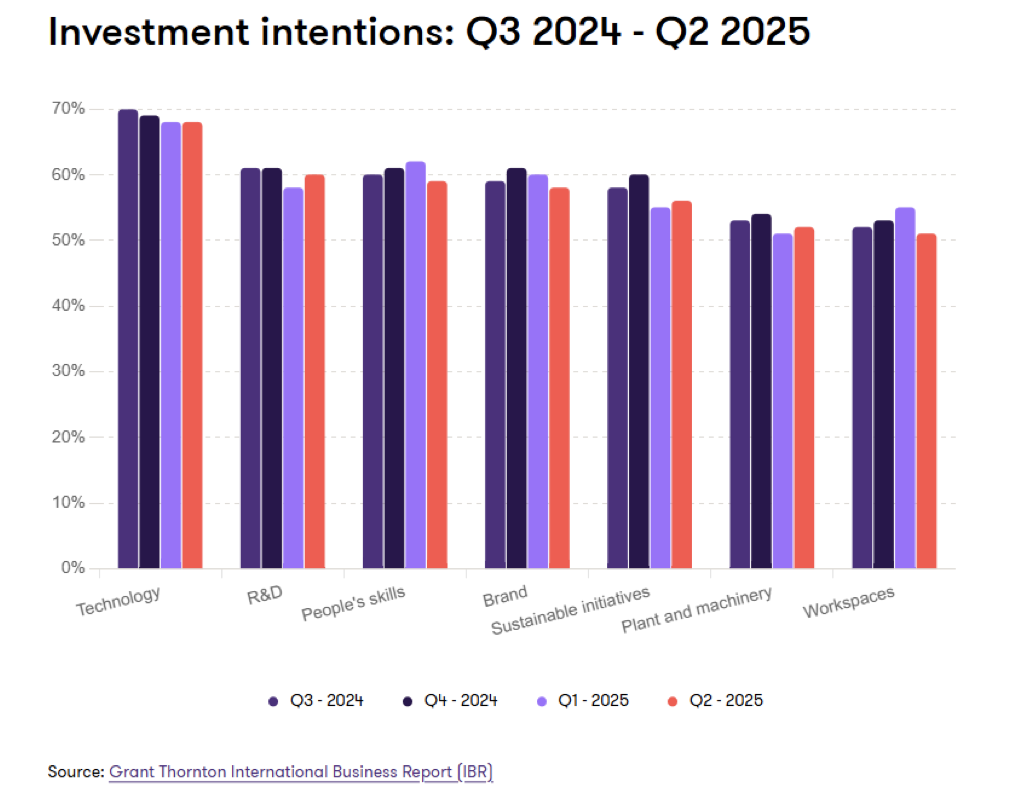

Investment strategies

Just as governments around the world are focused on trade deals with Trum and searching for new trading partners, mid-market business leaders continue to focus on re-engineering their own business by investing in technology, showing a strong propensity towards innovation and technology.

IT remains the top investment area for the mid-market, with 68% of business leaders planning to increase spending over the next 12 months (unchanged compared to Q1 2025). Europe recorded a 1 percentage point increase (from 62% to 63%) and Italy a slight decrease (from 56% to 52%). Within this, investment in AI remains the highest category at 67%, albeit down two points from the previous quarter; the same trend was recorded both in Europe at 64% and in Italy, 53%.

In contrast, investment in people dropped three points to 59% globally - the first time it has fallen in two years. In Europe the percentage remains unchanged at 51%, while in Italy businesses seems to be more optimistic on this aspect, with the relevant percentage rising from 44% to 51%. Employment expectations also fell three points, with 53% of business leaders now expecting to increase headcount over the next 12 months. Europe and Italy both recorded an opposite trend, with an increase from 46% to 49% and from 40% to 43%, respectively.

Data suggest that increased investment in technology may now be happening at the expense of employment and workforce development, as confirmed by a two-point rise in investment in research and development to 60% (in Europe up from 49% to 55% and in Italy from 46% to 54%) and by a one-point rise in investment in plant and machinery to 52% (in Europe up from 46% to 47% and in Italy from 48% to 53%); these data are against a sharp four-point decline (to 51%) in investment in workspaces (unchanged at 43% in Europe and down from 44% to 37% in Italy).

Global investment in sustainability initiatives increased one point to 56% (in Europe they remain unchanged at 52%, whereas Italy recorded a drop from 49% to 44%), a sign that, despite the recent regulatory shifts such as the EU’s Omnibus Package, businesses continue to prioritise sustainability as a strategic imperative for growth.

Sante Maiolica, CEO of Financial Advisory Services within Grant Thornton Italy, commented: “Our analysis shows how, in response to the rapidly evolving protectionist policies, many businesses are already taking measures to mitigate the impact of new tariff decisions and to diversify their target markets. As the global order is shaken by volatility and uncertainty, businesses are forced to redesign their strategies by diversifying their supply chains, exploring new markets, developing sustainable practices and transforming their business models thanks to the potential of new technologies. In times of commercial upheavals, it actually becomes even more urgent for businesses to become more competitive on international markets, and, in this sense, artificial intelligence can be a key lever to continue to keep on innovating, increasing productivity and compete”.