-

Transactional advisory services

Find out more about the transactional advisory services of Grant Thornton Financial Advisory Services

-

Valuations

Find out more about the valuations services of Grant Thornton Financial Advisory Services

-

Mergers and acquisitions

Find out more about the merger and acquisition services of Grant Thornton Financial Advisory Services

-

Forensic and investigation services

Find out more about the forensic and investigation services of Grant Thornton Financial Advisory Services

-

Recovery & reorganisation

Find out more about the Recovery & reorganisation services of Grant Thornton Financial Advisory Services

-

Business risk services

Find out more about the business risk services of Grant Thornton Financial Advisory Services

-

Business consulting

Find out more about the business consulting services of Grant Thornton Financial Advisory Services

-

Capital market

Capital market

-

Corporate and business tax

Find out more about our corporate and business tax services.

-

Direct international tax

Find out more about our direct international tax services.

-

Global mobility services

Find out more about our global mobility services.

-

Indirect international tax

Find out more about our indirect international tax services.

-

Transfer pricing

Find out more about our transfer pricing services.

-

Litigation

Our lawyers and accountants can manage all defense measures provided not only by the Italian law, but also by EU regulations and conventions

-

Family business

Find out more about our Family business services.

-

Legal

The client can be assisted in every need and with the same care both on important operations or disputes and on simple matters

-

Back office outsourcing

Find out more about our Back office outsourcing services

-

Business process outsourcing

Find out more about our business process outsourcing services.

-

Compilation of financial statements

Find out more about our compilation of financial statements services.

-

Tax compliance

Find out more about our tax compliance services.

-

Electronic invoicing

Find out more about our electronic invoicing services

-

Electronic storage

Electronic storage is an archiving procedure that guarantees the legal validity of a digitally stored electronic document

-

Revaluation of corporate assets

Find out your civil and fiscal revaluation of tangible, intangible and financial assets

-

Human resources consulting

Find out more about our human resources consulting services.

-

Payroll

Find out more about our payroll services.

-

HR News

HR News the monthly information newsletter by Grant Thornton HR

-

Cybersecurity

GT Digital helps clients structure information security management internal functions, also through partially or totally outsourced functions

-

Agile and Programme Management

GT Digital provides support in the adoption and implementation of different portfolio management

-

Robotic Process Automation

Our “BOT Farm” can rely on digital workers able to help clients in routine activities, allowing employees to deal with more added-value activities

-

Data strategy and management

GT Digital can support clients in seizing the opportunities offered by Big Data, from the definition of strategies to the implementation of systems

-

Enterprise Resource Planning

We support clients in selecting the most appropriate ERP System according to their specific needs, helping them also understand licensing models

-

IT strategy

GT Digital supports clients in making strategic choices, identifying innovation opportunities, comparing themselves with competitors

-

IT service management

We can support with software selection and with the implementation of dedicated tools for the management of ICT processes

-

DORA and NIS 2

The entry into force of the DORA Regulation and NIS2 represents a major step towards the creation of a harmonised regulatory framework

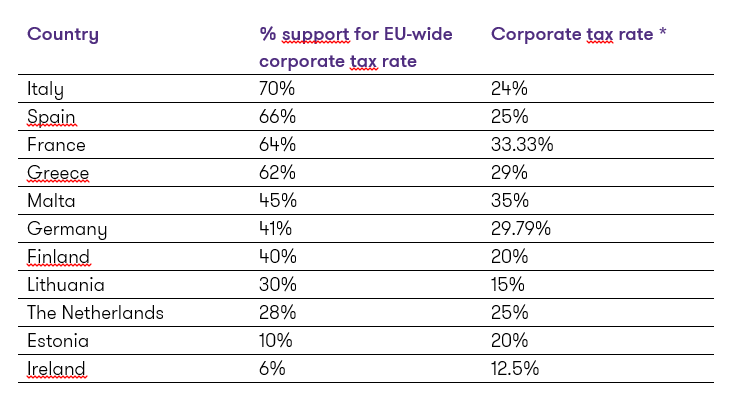

- The majority of European businesses (53%) would support the setting of an EU-wide corporate tax rate, finds Grant Thornton’s International Business Report (IBR). The research shows that support is particularly strong among business leaders in Italy (70%), Spain (66%), France (64%) and Greece (62%), where rates are higher than the European average.

Grant Thornton’s most recent quarterly global survey of 2,500 businesses in 36 economies also reveals that 63% of eurozone businesses would like to see further economic integration among EU member states. Their response to the question of a uniform tax rate offers a taste of where this is wanted.

Francesca Lagerberg, Global leader for tax services at Grant Thornton, comments: “In Europe, we have continued to see downward pressure applied to corporate tax rates. This year, Italy reduced its rate from 27.5% to 24%. French president-elect Emmanuel Macron has likewise vowed to cut corporate tax from 33.3% to 25%. But rates in these countries – alongside Germany at nearly 30% - are still among the highest in the EU. Our data tells us that business leaders want a more even playing field in future. Certainly, President Macron is already pushing for more tax harmonisation across EU states.”

However, some businesses feel strongly that each country should determine its own rate, with only 6% of businesses in Ireland, 10% in Estonia, 28% in the Netherlands and 30% in Lithuania supporting the idea of an EU-wide regime. Again, there is some correlation with the low rates these countries currently enjoy (see Figure 1). Outside the eurozone, only 16% of UK businesses express their support, as divergent policy pledges on corporate tax emerge ahead of the June general election.

Francesca Lagerberg adds:

“Corporate tax cuts are politically in-fashion as a route to reviving demand and stimulating investment. Lowering the rate to 15% is one of President Trump’s big economic promises, so it comes as little surprise to learn that, in eurozone countries where rates are low, most businesses do not welcome the prospect of these being raised to meet an EU-wide standard. They want to be able to compete with the world’s largest economy.”

“Business leaders in eurozone countries where corporate tax rates are high, on the other hand, wish for a more symmetrical experience. The exceptions are Germany and Malta, where rates are high, but where the majority of businesses would prefer each country to set its own. This could be because both countries are currently enjoying a competitive advantage: Germany remains the dominant force in Europe, with business optimism soaring high at 72%, and Malta is on track to be the fastest growing economy this year.”

Figure 1: Support for EU-wide corporate tax rate versus corporate tax rate as a percentage

*The overall corporate tax rate can range due to local tax trade rates; the figures stated here are the current average or indicative rate for most firms in each country.