The enabling law on the Italian tax system confirmed that tax litigation is among the priorities of the future reform. A look at the data is enough to understand the magnitude of the emergency: in Italy it takes the Court of first instance approximatively 643 days, on average, to give a judgement; 1,055 days to the Court of second instance. The total value of pending litigations amounts to 42 billion Euros; 63% of them have been pending since more than 2 years.

“It is impossible not to acknowledge - explains Andrea Giovanardi, lecturer of tax law at the University of Trento - that the courts of first and second instance do not manage to guarantee a quality level in their judgements, thus flooding the Court of Cassation, which, already overloaded with more than 50,000 pending appeals, cannot perform its function at its best”.

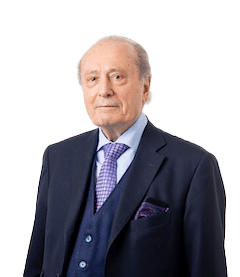

How to proceed, then? How to reverse the trend? “First of all, by creating the role of full-time magistrates specialised in tax matters - proposes Giuseppe Bernoni, former President of the Italian Board of Certified Chartered Accountants and of the Commission for local taxation - who carry out their profession on an exclusive basis, with mandatory periodic training and updating, as for other professional categories, and with a remuneration proportional to the delicate task entrusted to them”.

How to proceed, then? How to reverse the trend? “First of all, by creating the role of full-time magistrates specialised in tax matters - proposes Giuseppe Bernoni, former President of the Italian Board of Certified Chartered Accountants and of the Commission for local taxation - who carry out their profession on an exclusive basis, with mandatory periodic training and updating, as for other professional categories, and with a remuneration proportional to the delicate task entrusted to them”.

Tax judges are currently 2,700 lay judges, chosen based on their qualifications, not working exclusively on these matters, and underpaid. “The judges currently in force deserve great credit - continues Giovanardi - also because they work in very difficult conditions, and this explains how hard it is to clear the backlog of pending tax litigations without a real reform.

500 new full-time judges would be enough to reverse the trend: i.e. a competitive examination for 100 appointments per year for 5 years. The current judges would remain in office as single judges for court cases for a value lower than 3,000 Euros”. The speed-up of the current fiscal apparatus can no longer be postponed; “Nowadays, 47% of the appeals - reminds Bernoni - are upheld by the Court of Cassation and it is therefore impossible to reduce the backlog. Without a reform, tax amnesties and settlement concessions would need to be introduced every three years. An unacceptable prospect for Italy and for Europe”.