-

Transactional advisory services

Find out more about the transactional advisory services of Grant Thornton Financial Advisory Services

-

Valuations

Find out more about the valuations services of Grant Thornton Financial Advisory Services

-

Mergers and acquisitions

Find out more about the merger and acquisition services of Grant Thornton Financial Advisory Services

-

Forensic and investigation services

Find out more about the forensic and investigation services of Grant Thornton Financial Advisory Services

-

Recovery & reorganisation

Find out more about the Recovery & reorganisation services of Grant Thornton Financial Advisory Services

-

Business risk services

Find out more about the business risk services of Grant Thornton Financial Advisory Services

-

Business consulting

Find out more about the business consulting services of Grant Thornton Financial Advisory Services

-

Capital market

Capital market

-

Corporate and business tax

Find out more about our corporate and business tax services.

-

Direct international tax

Find out more about our direct international tax services.

-

Global mobility services

Find out more about our global mobility services.

-

Indirect international tax

Find out more about our indirect international tax services.

-

Transfer pricing

Find out more about our transfer pricing services.

-

Litigation

Our lawyers and accountants can manage all defense measures provided not only by the Italian law, but also by EU regulations and conventions

-

Family business

Find out more about our Family business services.

-

Legal

The client can be assisted in every need and with the same care both on important operations or disputes and on simple matters

-

Back office outsourcing

Find out more about our Back office outsourcing services

-

Business process outsourcing

Find out more about our business process outsourcing services.

-

Compilation of financial statements

Find out more about our compilation of financial statements services.

-

Tax compliance

Find out more about our tax compliance services.

-

Electronic invoicing

Find out more about our electronic invoicing services

-

Electronic storage

Electronic storage is an archiving procedure that guarantees the legal validity of a digitally stored electronic document

-

Revaluation of corporate assets

Find out your civil and fiscal revaluation of tangible, intangible and financial assets

-

Human resources consulting

Find out more about our human resources consulting services.

-

Payroll

Find out more about our payroll services.

-

HR News

HR News the monthly information newsletter by Grant Thornton HR

-

Cybersecurity

GT Digital helps clients structure information security management internal functions, also through partially or totally outsourced functions

-

Agile and Programme Management

GT Digital provides support in the adoption and implementation of different portfolio management

-

Robotic Process Automation

Our “BOT Farm” can rely on digital workers able to help clients in routine activities, allowing employees to deal with more added-value activities

-

Data strategy and management

GT Digital can support clients in seizing the opportunities offered by Big Data, from the definition of strategies to the implementation of systems

-

Enterprise Resource Planning

We support clients in selecting the most appropriate ERP System according to their specific needs, helping them also understand licensing models

-

IT strategy

GT Digital supports clients in making strategic choices, identifying innovation opportunities, comparing themselves with competitors

-

IT service management

We can support with software selection and with the implementation of dedicated tools for the management of ICT processes

-

DORA and NIS 2

The entry into force of the DORA Regulation and NIS2 represents a major step towards the creation of a harmonised regulatory framework

Law Decree n. 73 dated 25 May 2021 (so-called “Sostegni-bis” decree) was published in the Official Gazette (no. 123 dated 25 May 2021) and includes urgent measures addressing the COVID-19 emergency.

Below is a description of the main tax updates provided.

Art. 1 – Non-refundable allowance for economic operators

New non-refundable allowances are provided for economic operators. In particular:

“Automatic” renewal of the contribution under “Sostegni” Decree

A non-refundable allowance is granted to all workers with a VAT registration number being already active at 26 May 2021, who filed an application for or have lawfully received the allowance provided under Law Decree no. 41/2021 (so-called “Sostegni” Decree).

Such allowance, equal to 100% of the amount granted in compliance with the provisions under the Sostegni Decree, will be issued directly by the Revenue Office, without the need for taxpayers to file a further application, or – if requested – granted as a tax credit.

The allowance cannot exceed 150,000 Euro and is anyway granted for an amount of at least 1,000 Euro for individuals and of at least 2,000 Euro for persons other than individuals.

New non-refundable allowance provided by Sostegni-bis Decree

A further non-refundable allowance is granted – within the maximum limit of 150,000 Euro – to all taxpayers having a VAT registration number and carrying out a business activity, artistic activity, or professional activity, or generating agricultural income, who, in the second tax period preceding the effective date of this decree (i.e. 2019 for calendar-year taxpayers):

- registered revenues not higher than 10 million Euro and

- suffered an average monthly loss in turnover of at least 30% in the period from 1st April 2020 to 31st March 2021 compared to the period from 1st April 2019 to 31st March 2020.

For those who received the contribution under art. 41 of Law Decree no. 41/2021 (so-called “Sostegni” Decree), the amount of this allowance is calculated as a percentage of the difference between the average monthly turnover and considerations of the period from 1st April 2020 to 31st March 2021 and the average monthly turnover and considerations of the period from 1st April 2019 to 31st March 2020 as follows:

Those who, after filing the application for the allowance under Sostegni Decree, already received the “automatically renewed” allowance provided under para. 1, can obtain the further amount – if higher – provided under Sostegni-bis Decree (this is possible as the reference period is different), calculated as explained above.

In this case, the amounts already received or obtained as tax credit will be deducted by the Revenue Office.

If the amount calculated as “further allowance” is lower than the amount calculated under the “automatic renewal”, the Revenue Office would not consider the application.

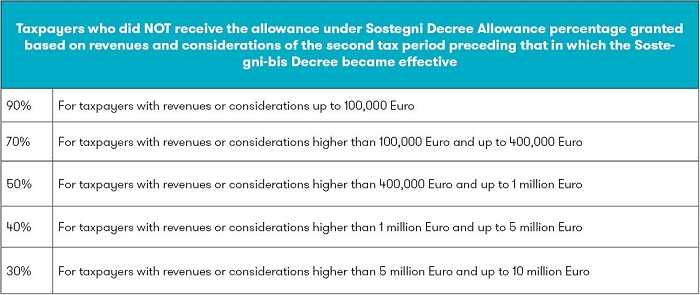

The allowance, within the same limit of 150,000 Euro, is also granted to taxpayers who did not benefit from the first allowance provided by the Sostegni Decree.

In this case, the following percentages are applied to the abovementioned turnover difference:

To obtain such allowances, an application must be filed electronically with the Revenue Office within sixty days after the starting of the electronic procedure for its filing (the procedure will be defined with a proper order by the Director of the Revenue Office).

Taxpayers that must file the periodic VAT settlements communication under art. 21-bis of Law Decree dated 31 May 2010, no. 78 can file the application only after filing the communication relevant to quarter 1, 2021.

Further contribution under Sostegni-bis Decree due to the worsening of economic results

Lastly, a further non-refundable contribution, subject to the authorization of the European Commission, is granted to all taxpayers who perform a business activity, an artistic activity, or a professional activity or who generate agricultural income, who have a VAT registration number, are resident or established within the territory of State, and generated revenues or considerations not higher than 10 million Euros in the second tax period preceding that in which the Decree under analysis became effective.

It is specified that this contribution is granted provided that a worsening of the economic result occurred with reference to the tax period being current at 31 December 2020, compared to the result referred to the tax period being current at 31 December 2019; such worsening should be equal to or higher than a certain percentage that will be defined under a proper decree by the Ministry of Economy and Finance.

The amount of the non-refundable contribution, within the limit of 150,000 Euro, is calculated by applying the percentage defined under the abovementioned decree by the Ministry of Economy and Finance to the difference of the economic result of the year registered in the FY at 31 December 2020 compared to that registered in the FY at 31 December 2019 – net of non-refundable allowances already received.

In order to obtain this further contribution, a specific application must be filed with the Revenue Office, according to the procedures that will be subsequently defined, provided that the tax return relevant to the tax period at 31 December 2020 is filed by 10 September 2021.

Art. 4 – Extension of the tax credit

The allowance provided under art. 28 of Law Decree no. 34/2020 (so-called “Rilancio” Decree) relevant to the tax credit for rental fees on real estate for non-residential use and business lease is extended to 31 July 2021 in favour of:

- companies in the tourism and accommodation industry,

- travel agencies, and

- tour operators,

provided that they suffered a decrease in turnover or considerations of at least 50% in the reference 2021 month compared to the same month in 2019.

Additionally, with reference to fees paid in each month from January 2021 to May 2021, such tax credit is granted to:

- Taxpayers carrying out a business activity, artistic activity or professional activity, whose revenues did not exceed 15 million Euro in the second tax period preceding that in which the decree at issue became effective (i.e. 2019 if the FY corresponds to the calendar year), provided that the average monthly turnover and considerations in the period from 1st April 2020 and 31st March 2021 is lower by at least 30% compared to the average monthly turnover and considerations in the period from 1st April 2019 and 31st March 2020;

- Non-commercial entities, entities in the voluntary sector, legally recognized religious bodies, in relation to fees for the rent, lease or concession of real estate for non-residential use and used to the performance of institutional activities.

Lastly, it is pointed out that the tax credit is granted in any case to those taxpayers who started their activity as 1st January 2019.

Art. 8 – Urgent measures for textile and fashion industry

The tax credit on final inventories provided under art. 48-bis of Law Decree no. 34/2020 (so-called “Rilancio” Decree) in favour of the textile, fashion, and accessories industry, is extended also to the tax period at 31 December 2021.

The tax credit is equal to 30% of the value of final inventories exceeding the average value registered in the three tax periods preceding that for which the tax credit is granted.

The Decree of the Ministry for the economic development that will be issued by 15.6.2021 will establish the criteria for the correct identification of the economic industries in which the beneficiaries of this incentive operate.

The benefit of the incentive is subject to a proper notification to the Revenue Office, to be submitted according to the terms and procedures established under an order to be issued by 25.6.2021.

Lastly, we point out that the tax credit can be only offset in the F24 form in the tax period following that in which it arises.

Art.9 - Extension of the suspension of plastic tax terms

The following are extended to 30 June 2021:

- The terms for the payments due in the period from 8 March 2020 to 30 June 2021 following payment orders issued by collection agencies, as well as payment notices provided under articles 29 and 30 of Law Decree dated 31 May 2010, no. 78;

- The suspension of withholdings by the collection agency made on wages, salaries, and other indemnities related to a working or employment relationship – including those due subsequently to a dismissal and as pensions, as indemnities in place of a pension, and as retirement indemnities – by virtue of a foreclosure procedure.

The acts and provisions adopted and actions taken by the collection agency in the period from 1st May 2021 to 26th May 2021, as well as the effects produced and legal relationships generated based on such provisions remain valid.

Additionally, the coming into force of the so-called plastic tax is postponed to 1st January 2022.

Art. 10 – Measures to support the sports industry

The Decree provides for an extension of the reference period for relevant investment to determine the tax credit related to advertisement investment and sponsorship in favour of determined amateurish and professional sports companies and associations.

We remind that the allowance is granted to the extent of 50%, provided that investment is:

- equal to at least 10,000 Euro;

- addressed to professional sports leagues and companies and amateurish sports associations whose revenues generated in Italy in FY 2019 are equal to at least 150,000 Euro and up to 15 million Euro;

- made from 1st July 2020 and up to 31st December 2020;

- made through a bank or postal remittance, or through other payment systems other than cash (e.g. credit card, debit card, prepaid card, bank cheques, banker’s draft).

Following the amendments introduced under “Sostegni-bis” Decree, the allowance will be calculated also based on investment made from 1st January 2021 to 31st December 2021.

Art. 14 – Taxation of capital gain from innovative start-ups

A temporary allowance is introduced with reference to capital contributions deriving from the sale of shareholdings in innovative start-ups or innovative SMEs acquired by subscribing their share capital.

In particular, the rule provides for an exemption from the payment of taxes on the income generated from the sale of shareholdings:

- realized by individuals outside the performance of their business activity;

- held in companies qualified as innovative start-ups or as innovative SMEs;

- acquired through the subscription of share capital in the period between 1st June 2021 and 31st December 2025, and

- held for at least 3 years.

It is specified that cash contributions registered among share capital and share premium reserve of innovative start-ups and innovative SMEs entitle to the exemption, also in case of conversion of bonds into newly issued shares.

The rule provides for a further benefit for individuals, besides the performance of the business activity.

Specifically, in case of sale of shareholdings held in partnerships and companies (being either resident in Italy or not), the realized capital gain will be exempt from income taxes if:

- It is re-invested in shares or stock in innovative start-ups or innovative SMEs, either residing in Italy or not, by subscribing share capital by 31st December 2025;

- Such re-investment is made within one year after the capital gain is realized.

The re-investment obligation is provided for realized capital gains and, therefore, share capital must be subscribed in cash.

Capital gains derived from both qualifying and non-qualifying shareholdings.

Art. 18 – Recovery of VAT on non-collected receivables

The decree includes updated provisions concerning the possibility to issue VAT credit notes (under art. 26, para.2 of Presidential Decree no. 633/1972) in case of insolvency proceedings.

More specifically, such credit notes can be issued:

- Starting from the date on which the transferee is subjected to an insolvency procedure, or from the date of the decree that validates a debt restructuring agreement under art. 182-bis of Royal Decree dated 16 March 1942, no. 267, or from the publication in the Companies’ Register of an approved restructuring plan pursuant to art. 67, para. 3, letter d), of Royal Decree dated 16 March 1942, no. 267;

- Following individual unsuccessful executive procedures.

It is also specified that a debtor can be considered as subjected to an insolvency procedure at the following dates:

- Date of the judgment declaring insolvency;

- Date of the order establishing the receivership procedure;

- Date of the decree admitting the arrangement with creditors procedure;

- Date of the decree establishing the extraordinary administration proceedings for large insolvent companies.

The current provisions related to unsuccessful executive procedures (under art. 26, para. 12, of Presidential Decree no. 633/1972) remain valid.

Lastly, the Decree specifies the procedure for the recovery of VAT in case the transferee – being subject to one of the abovementioned insolvency procedures – pays the consideration due at a later date than the terms provided under point 1 mentioned above.

Art. 19 – Extension of credits and innovative “ACE” 2021

The Decree provides for an extension to 31 December 2021 of the possibility to convert into tax credit those deferred tax assets referred to losses and to the “ACE” incentive generated following to the sale of financial credits due from defaulting debtors.

Moreover, the measure concerning the “ACE” incentive related to the tax period following that at 31 December 2020 is also strengthened. In particular, changes in equity can be facilitated through the application of a 15% rate. The “ACE” incentive, calculated based on such strengthened rate, can be applied also through the granting of a tax credit.

Art. 20 – Tax credit for new capital goods

The Decree provides for the possibility for all taxpayers with revenues or considerations equal to at least 5 million Euro to offset the tax credit for new capital goods – other than those listed under Annex A to law dated 11 December 2016, no. 232 and purchased from 16 November 2020 to 31 December 2021 – in a single annual instalment.

Art. 22 – Extension of credits in FY 2021

For the year 2021, in order to increase the liquidity of companies, the maximum limit of tax credits and contributions that can be offset pursuant to art. 17 of legislative Decree dated 9 July 1997 no. 24 or repaid to taxpayers having an account registered at the collection agency has been increased to 2 million Euro.

Art. 32 – Tax credit for the purchase of protection devices

An ad hoc tax credit is provided for sanitization activities and the purchase of protection devices. In particular, those who carry out a business activity, artistic activity, or professional activity (as well as non-commercial entities) can benefit from a tax credit equal to 30% of the costs incurred in June, July, and August 2021 for the sanitization of places and tools used, as well as for the purchase of individual protection devices and other devices aimed to guarantee workers’ and users’ safety and health, including costs for COVID-19 swabs.

The tax credit is granted to a maximum amount of 60,000 Euro per each beneficiary.

The following expenses can benefit from the measure:

- Sanitization of places where the working and institutional activity is carried out, and of tools used within the performance of such activity;

- Swabs to those who carry out their activities;

- Purchase of individual protection devices, such as face masks, gloves, fencing masks, and safety goggles, protective suits and shoe covers, being compliant with the essential safety requirements provided under the European regulation;

- Purchase of detergent and disinfectant products;

- Purchase of safety measures other than those listed under letter c), such as thermometers, temperature scanners, decontamination and sanitization carpets and trays, being compliant with the essential safety requirements under the European regulation, including any installation costs;

- Purchase of devices to ensure interpersonal distance, such as protection barriers and panels, including any installation costs.

Such tax credit can be used in the tax return, or offset pursuant to art. 17 of Legislative Decree no. 241/1997.

A maximum limit of public resources to support this measure is established and is equal to 200 million Euro.

Art. 67 – Urgent measures for printing industry and advertising investment

The tax credit relevant to advertising investment in newspapers and magazines, also in digital format, is extended to the two-year period 2021 and 2022, in the measure of 50% of the value of investment made.

With reference to 2021, concerned taxpayers will have to submit, through the proper form:

- The communication to access the tax credit including data of investment made or to be made in the concerned year within the period from 1st to 30 September;

- The substitute declaration relevant to investment made, aimed to declare that investment indicated in the previously submitted communication to access the tax credit was actually made in the concerned year and that it meets the indicated requirements.

Lastly, starting from 2023, this tax credit under analysis will become permanently valid (under art. 57-bis, para. 1 of Law Decree no. 50/2017), though according to the procedures and rates provided by the first implementation of the rule (year 2018).